SIP Trunking Solutions for Banks & Financial Institutions

| Feature | Legacy Phone Lines | SIP Trunking with DIDlogic |

|---|---|---|

| Monthly Cost | High, fixed rental fees | Usage-based, predictable |

| Scalability | New lines per branch | Instant, flexible scaling |

| Security | Minimal encryption | End-to-end encryption + fraud protection |

| Multi-Branch Support | Separate systems | Centralized communications |

| Compliance | Limited tracking | PCI, SOX, GDPR-ready |

| Reliability | Single point of failure | Redundant routing, disaster recovery |

Sign up with DIDlogic to explore SIP trunking and pricing instantly or talk to our sales team for a tailored setup.

How DIDlogic Powers Bank Communication

Banking Features That Matter Most

Implementation: Switching Your Bank to SIP Trunking

PBX/UC compatibility (Cisco, Avaya, 3CX, Asterisk, etc.).

Firewall/router configured for SIP traffic.

If you run VoIP today, you’re SIP-ready.

Provision SIP trunks with DIDlogic.

Test routing for fraud, credit, and customer care lines.

Most banks deploy in days, not weeks.

Integrate with CRM and fraud alert systems.

Ensure security awareness for compliance.

Your teams stay focused on customers while communications upgrade silently.

FAQs

How do SIP trunks improve regulatory compliance in banks?

SIP trunks support encrypted voice communications, which is critical when you’re handling sensitive financial conversations daily. Every call generates audit-ready records, timestamps, duration, caller information, that compliance teams can review during regulatory examinations. These logs help satisfy requirements under PCI DSS for payment card data, SOX for financial reporting accuracy, and GDPR for customer privacy protection in European markets. DIDlogic’s system integrates with existing compliance infrastructure, so you’re not building something from scratch. The encryption protocols (TLS and SRTP) protect voice data in transit, making interception far harder for unauthorized parties. It’s not a complete compliance solution by itself, you still need proper policies and training, but it provides the technical foundation that regulators increasingly expect. Traditional phone lines simply don’t offer this level of documentation and security built in.

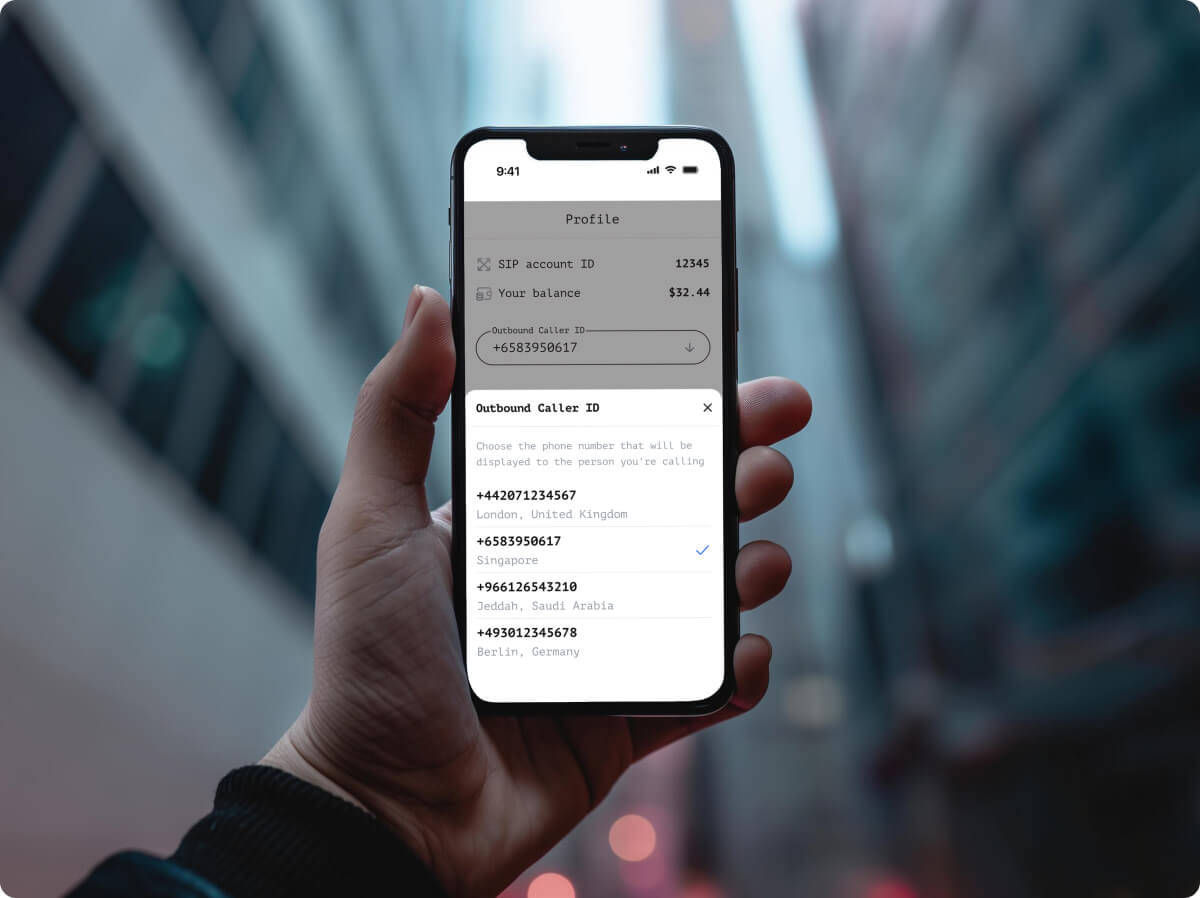

Can SIP trunking handle international calls for global banks?

Yes, and it’s actually one of the stronger use cases for the technology. DIDlogic provides DID numbers in over 150 countries, which means your London office can have local UK numbers, your Singapore branch gets local numbers there, and clients call what feels like a neighborhood bank rather than dialing internationally. This supports cross-border client communication without the astronomical costs traditional carriers charge for international voice circuits. You can route calls between branches over your private network rather than paying per-minute international rates. For global banks with wealth management clients traveling frequently, this flexibility matters. The call quality stays consistent regardless of where it originates or terminates. Some banks even use local DIDs in markets where they don’t have physical offices, giving them a communication presence before opening branches.

What happens if a bank’s internet connection fails?

Automatic failover kicks in within seconds, rerouting calls to backup paths you’ve configured ahead of time. Critical lines, fraud departments, customer care, wire transfer authorization, remain reachable even when your primary internet connection drops. DIDlogic’s system can redirect to mobile phones, secondary locations, or even PSTN backup lines if you’ve kept some as insurance. Most banks set up redundant internet connections from different providers specifically to avoid this scenario, but failover is your safety net when both fail simultaneously. The transition is usually seamless from the caller’s perspective; they might not even realize something went wrong on your end. Obviously, you want reliable connectivity as your primary strategy, but banking can’t afford downtime. Some institutions use 4G/5G backup connections that automatically take over, though bandwidth might be reduced during the failover period

Do SIP trunks integrate with secure mobile banking apps or remote call centers?

Yes, they integrate quite well with modern UC platforms. DIDlogic SIP trunks connect with PBX and unified communications systems that power remote agents, mobile banking apps, and customer service platforms spread across multiple locations. This means your call center agents can work from home, or anywhere, really, while still accessing the same phone system and customer data as if they were in the main office. The SIP trunk handles the voice connectivity while your existing security infrastructure (VPNs, access controls, authentication) protects the data side. Mobile banking apps that include “tap to call” features route through the same system, maintaining consistent call quality and security standards. It’s particularly useful for banks that shifted to hybrid work models recently. The key is that SIP trunking is just the voice layer; it works alongside your other security measures rather than replacing them.

How many SIP channels does a regional vs national bank need?

Regional banks typically need somewhere between 10–50 channels depending on branch count and call volume during peak hours. A community bank with three branches might run comfortably on 15–20 channels most days. National banks, though? They often require hundreds of channels distributed across dozens or even hundreds of branches, plus call centers and specialized departments. DIDlogic scales instantly, so you’re not locked into rigid capacity decisions made months in advance. The actual number depends heavily on your specific operation, a retail-focused bank with lots of customer service calls needs more than a commercial bank handling fewer but longer business conversations. Most banks overprovision slightly to avoid busy signals during month-end rushes or when mortgage rates drop and refinance applications spike. Start by analyzing your busiest hour across all locations, then build in maybe 20% headroom for unexpected volume.

Is SIP trunking more secure than traditional phone lines?

Yes, though it requires proper implementation. With encryption protocols and fraud monitoring built in, SIP trunking offers stronger data protection than legacy PSTN lines that banks have used for decades. Traditional copper lines can be physically tapped with relatively basic equipment, something that concerns security teams in financial institutions. SIP encryption makes interception far more difficult, requiring sophisticated attacks rather than simple wiretaps. DIDlogic includes fraud monitoring that watches for unusual patterns like sudden international calling spikes or toll fraud attempts targeting your system. The voice data travels over your controlled network rather than through public telephone infrastructure you don’t manage. That said, SIP trunking isn’t automatically secure just by existing; you need proper firewall configuration, strong passwords, and regular security audits. Think of it as having better locks on the door, but you still need to remember to actually lock them.