SIP Trunking Solutions for Efficient Financial Services Communication

Financial institutions face unique challenges in maintaining secure, compliant, and reliable communication systems. From investment firms and insurance companies to banks and credit unions, the financial sector requires telecommunications solutions that balance security, cost efficiency, and exceptional service quality. Session Initiation Protocol trunking offers a specialized approach for financial organizations seeking to modernize their communications infrastructure.

DIDlogic delivers IP-based telephony solutions specifically engineered for financial services companies. Our systems provide the security, reliability, and compliance capabilities that financial institutions demand, while offering significant cost advantages over traditional phone systems.

What Is Voice over IP Technology for Financial Institutions?

The financial services sector relies heavily on voice communications for client interactions, internal collaboration, and transaction processing. Legacy phone systems often introduce unnecessary costs and limitations that can hamper operational efficiency and client service quality.

IP-based telephony transforms voice calls into digital data packets transmitted over internet connections rather than traditional telephone lines. This fundamental change delivers several key advantages for financial organizations:

- Enhanced security through advanced encryption

- Improved reliability with redundant connection paths

- Significant cost reductions for calling services

- Seamless integration with financial software platforms

- Flexible remote work capabilities for staff

- Detailed call analytics for compliance purposes

Banks, investment firms, and insurance companies increasingly adopt these solutions to strengthen client relationships while optimizing operational expenditures.

Core Benefits for Financial Services Organizations

Enhanced Security and Compliance

Financial institutions must adhere to strict regulatory requirements regarding communication security and data protection. Modern IP telephony systems support these obligations through:

- End-to-end encryption of voice communications

- Detailed call logging and recording capabilities

- Role-based access controls for system administration

- Secure integration with CRM and financial platforms

- Comprehensive audit trails for compliance verification

DIDlogic’s solutions implement multiple security layers specifically designed for financial services requirements, including compliance with regulations like GLBA (Gramm-Leach-Bliley Act) and PCI DSS when applicable.

Business Continuity Assurance

Financial organizations cannot afford communication disruptions that might impact client service or transaction processing. Cloud-based voice solutions provide robust contingency capabilities:

- Geographic redundancy across multiple data centers

- Automatic failover to backup connection paths

- Flexible call routing to alternate locations or mobile devices

- Remote system administration capabilities

- Uninterrupted access to critical communication functions

These features ensure that market fluctuations, client emergencies, or time-sensitive transactions can be handled without interruption, even during system outages or facility closures.

Cost Optimization and Predictable Expenses

The financial services sector constantly seeks to optimize operational expenses while maintaining service excellence. Digital voice transmission offers significant cost advantages:

- Elimination of separate voice and data networks

- Reduced domestic and international calling expenses

- Consolidated vendor management

- Decreased hardware maintenance costs

- More predictable monthly expenses

- Scalability without major capital investments

A mid-sized financial institution typically achieves 30-50% reduction in telecommunications expenses after implementing internet protocol voice solutions. These savings directly impact profitability while maintaining or improving service capabilities.

Client Service Enhancement

Financial relationships depend heavily on clear, responsive communication. Modern voice systems improve client interactions through:

- Call routing based on client relationships or account types

- Integration with financial CRM platforms

- Detailed call history and client interaction records

- Multiple communication channels (voice, text, video)

- High-definition audio quality

- Reduced wait times through intelligent routing

These capabilities strengthen client relationships while giving financial advisors and service representatives the tools they need to deliver exceptional experiences.

Scalability for Market Expansion

Financial services organizations frequently add new locations, acquire competitors, or expand into new market segments. IP-based communication systems scale effortlessly to accommodate growth:

- Rapid deployment of new locations or branches

- Consistent communication features across all offices

- Centralized management of distributed teams

- Easy integration of acquired organizations

- Unified client experience regardless of location

This flexibility supports strategic market expansion without the communication infrastructure limitations that often accompanied growth with legacy systems.

Implementation Considerations for Financial Organizations

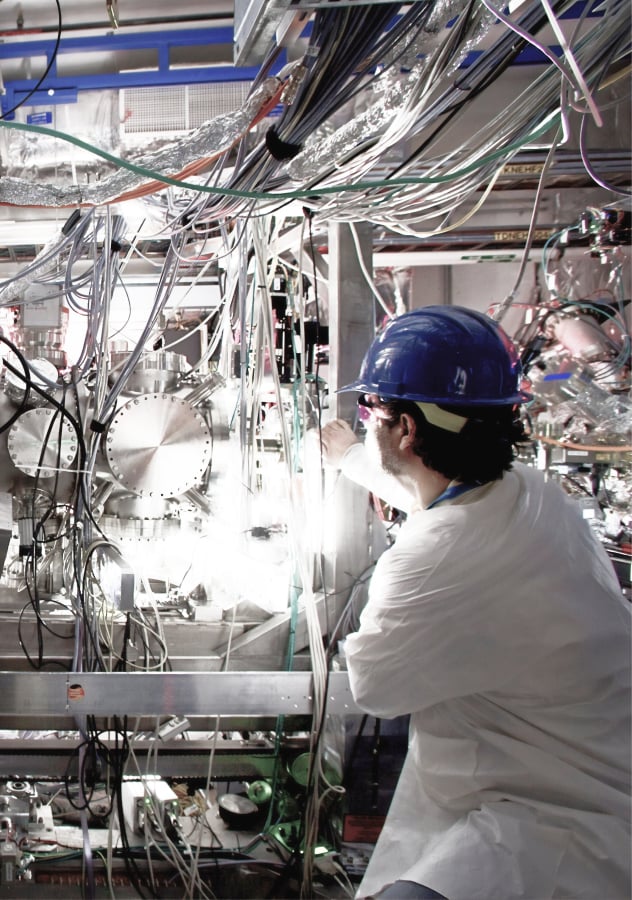

Security Architecture Assessment

Before transitioning to IP-based telephony, financial institutions should conduct comprehensive security evaluations:

- Voice encryption protocols and standards

- Network segmentation between voice and financial data

- Authentication mechanisms for system access

- Vulnerability testing methodologies

- Regulatory compliance verification

DIDlogic’s security specialists assist financial clients in designing appropriate security architectures that protect sensitive communications while meeting regulatory requirements.

Integration with Financial Platforms

Maximum value comes from seamless integration between communication systems and financial software platforms:

- Customer Relationship Management (CRM) systems

- Trading platforms and market data services

- Compliance and recording systems

- Client portal and self-service applications

- Document management and workflow tools

Our solution architects work directly with financial IT teams to establish secure, efficient integrations that enhance workflow efficiency while maintaining data security.

Disaster Recovery Planning

Financial institutions must maintain communication capabilities during disruptions. Effective planning includes:

- Documented recovery procedures for various scenarios

- Regular testing of failover mechanisms

- Staff training on contingency protocols

- Geographic distribution of system resources

- Redundant connection paths with multiple carriers

DIDlogic’s implementation methodology includes comprehensive disaster recovery planning tailored to each financial organization’s specific requirements and risk profile.

Migration Strategy Development

Financial organizations benefit from carefully planned migration approaches:

- Assessment Phase: Evaluate current systems, document requirements, identify compliance needs

- Design Phase: Create technical architecture aligned with security and functional requirements

- Pilot Implementation: Deploy in limited scope to validate functionality and security

- Phased Rollout: Gradually transition departments or locations

- Legacy Decommissioning: Systematically retire old systems after successful transition

This methodical approach minimizes risk while allowing for adjustments based on actual experience within the specific financial environment.

Technical Specifications

DIDlogic’s financial sector voice solutions include:

- Enterprise-Grade Security: Multiple encryption layers and security controls

- Redundant Connectivity: Diverse carrier connections for reliability

- Quality Assurance: Advanced traffic management for optimal voice quality

- Call Recording: Secure, compliant recording with encryption and retention policies

- Analytics Platform: Usage patterns, service metrics, and compliance reporting

- Business Continuity: Automatic failover and disaster recovery capabilities

- Directory Integration: Synchronization with identity management systems

- API Framework: Secure integration with financial platforms

Our solutions architects configure these components based on each institution’s specific requirements, ensuring the appropriate balance of security, functionality, and cost-effectiveness.

Regulatory Considerations for Financial Implementations

Financial organizations must navigate specific regulatory requirements when implementing communication systems:

Call Recording and Retention

Many financial transactions require documented voice records. Modern systems support these requirements through:

- Selective or comprehensive call recording

- Encrypted storage with access controls

- Customizable retention policies

- Searchable archives for audit purposes

- Chain of custody documentation

Data Protection Standards

Financial communication often includes sensitive personal and account information. Protection measures include:

- End-to-end encryption of voice traffic

- Secure transmission protocols

- Access controls and authentication

- Data loss prevention mechanisms

- Detailed access logging

Cross-Border Considerations

International financial organizations must address varying regulatory requirements:

- Jurisdiction-specific data storage requirements

- International calling compliance

- Country-specific privacy regulations

- Cross-border data transfer rules

- Local telecommunications regulations

DIDlogic’s compliance specialists help financial clients navigate these complex requirements with solutions tailored to their specific regulatory environment.

Implementation Process with DIDlogic

1. Security and Requirements Analysis

Our financial solutions team begins with a comprehensive assessment:

- Current system inventory and security posture

- Compliance requirements and risk factors

- Integration requirements with financial platforms

- Business continuity objectives

- User experience and client service goals

This assessment forms the foundation for a secure, compliant solution design.

2. Solution Architecture and Design

Based on assessment findings, our engineers develop a customized solution:

- Security architecture and controls

- Technical specifications and protocols

- Implementation timeline and milestones

- Training and support plans

- Migration strategy for minimal disruption

The proposal undergoes security review to ensure alignment with financial sector requirements.

3. Controlled Implementation

A measured approach minimizes risk during transition:

- Initial deployment in non-critical departments

- Security validation and penetration testing

- User acceptance testing and feedback

- Performance optimization

- Documentation and procedure development

This phase confirms security and functionality before wider deployment.

4. Enterprise Deployment and Training

Once validated, full implementation proceeds:

- Phased rollout across departments or locations

- Comprehensive security and usage training

- Administrator training for internal IT staff

- Documentation distribution

- Help desk preparation

Our implementation specialists remain engaged during critical transition periods to ensure smooth adoption.

5. Ongoing Support and Compliance Monitoring

DIDlogic provides continuous support after implementation:

- 24/7 technical assistance

- Regular security updates and patches

- Quarterly compliance reviews

- Usage analytics and optimization recommendations

- Continuous improvement consultation

This ongoing partnership ensures your communication systems remain secure, compliant, and effective as technology and regulations evolve.

Frequently Asked Questions

How does IP telephony enhance security for financial communications?

Modern voice solutions implement multiple security layers specifically designed for financial services, including transport layer encryption, access controls, and secure authentication. Communications transmitted over IP networks can actually provide stronger security than traditional phone lines through end-to-end encryption, detailed audit logs, and integration with identity management systems. DIDlogic’s solutions implement financial-grade security that often exceeds regulatory minimums.

What reliability standards should financial institutions expect?

Financial-grade communication systems should maintain at least 99.99% uptime (less than 53 minutes of downtime annually). This requires redundant connections, geographic distribution of services, automatic failover mechanisms, and continuous monitoring. DIDlogic provides service level agreements with guaranteed reliability metrics and financial remediation for any service interruptions, ensuring institutions can maintain client communications under virtually any circumstances.

How do voice solutions integrate with our existing financial systems?

Modern communication platforms offer secure API integration with CRM systems, trading platforms, compliance recording systems, and customer service applications. These integrations can automate client identification, provide advisors with relevant account information during calls, and document interactions for compliance purposes. DIDlogic’s solution architects specialize in designing secure integrations that enhance workflow while maintaining strict data protection standards.

What cost savings can financial organizations typically expect?

Financial institutions generally realize 30-50% reduction in telecommunication expenses after implementation. These savings come from elimination of legacy phone lines, reduced long-distance charges, decreased maintenance costs, and operational efficiencies. A detailed ROI analysis during the assessment phase will quantify specific savings opportunities based on your current expenditures and call patterns.

How quickly can we implement without disrupting operations?

Implementation timelines vary based on organization size and complexity, but most financial institutions can complete the transition within 60-90 days using a phased approach. Critical client-facing functions typically experience zero downtime during properly managed migrations. DIDlogic’s implementation methodology includes detailed planning to ensure business continuity throughout the transition process.

Ready to Transform Your Financial Communications?

DIDlogic specializes in helping financial services organizations implement secure, reliable, and cost-effective communication solutions. Our team understands the unique security and compliance challenges facing financial institutions and designs systems that enhance client service while reducing operational expenses.

Contact our financial sector specialists to schedule a consultation and learn how internet-based voice services can strengthen your communication capabilities.

Related Solutions: